Hrdf levy exemption 2021 - Payroll Panda Sdn Bhd — What is the HRDF Levy and which employers are eligible to contribute?

Recent Posts

- Mayat tangmo no censor

- Hartal meaning in malay

- Soalan bocor spm 2022

- Lirik lagu bad dolla

- Master chef malaysia

- Resepi singgang ikan tongkol

- Video uel tular

- Pengakap dalam bahasa arab

- Sflix pro

- Ayam pedas nyonya kfc

- 27 november zodiac

- Chris rock net worth

- Google tra

- Utar map

- Gambar beruang kutub

- Feel as much as you know

- Scammer full episode

- Photopia self photo studio

HRDF exemption 2021

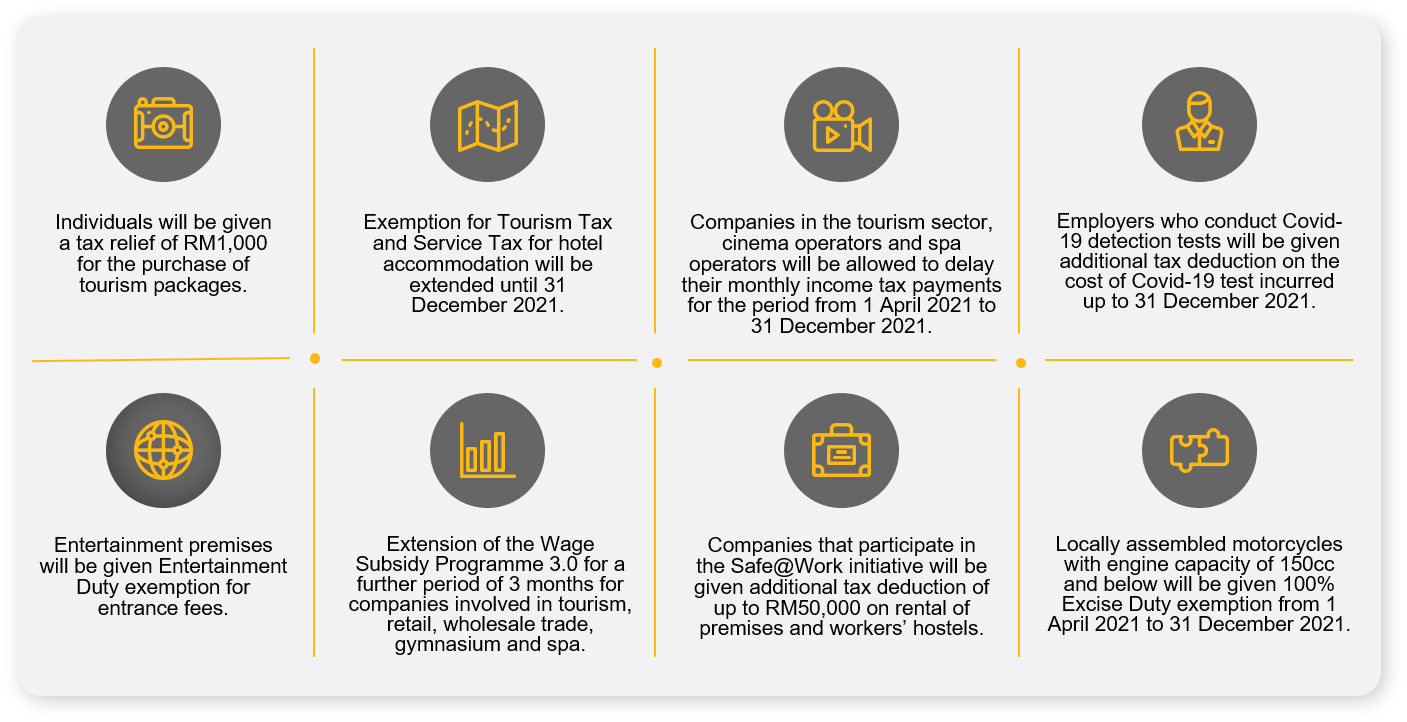

However, empty malls, lower exports and imports, poor consumer sentiments, low profits and rising unemployment rate towards the end of year 2020, it would be an uphill battle for the nation in the year 2021.

Employers are exempted from paying levy for the months of January 2021 to June 2021.

It is therefore most inappropriate for the government to impose the levy on the plantation sector for training of foreign workers and is viewed as further taxing the plantation sector.

Employers need to register with HRDF to avoid fine

Stamp Duty Exemption for Perlindungan Tenang Products It is proposed that the exemption period for the purchase of Perlindungan Tenang products will be extended for another 5 years, to further encourage more low-income groups to have insurance and takaful coverage.

Go to hotspots and vaccinate everyone.

The ceiling for total number of 200 employees will be increased from 200 to 500 employees.

- Related articles

2022 blog.dabchy.com