Lifestyle tax relief 2022 malaysia - Personal Tax Relief For 2022

Recent Posts

- Kes sarawak hari ini

- Sekolah rendah tahfiz negeri pahang

- Resepi sup ekor che nom

- Semak kelulusan pengeluaran khas kwsp

- Bkm 2022 login

- Meesaya murukku tamilgun

- Pendidikan moral tingkatan 1 jawapan

- Protege meaning

- Jawapan buku aktiviti bahasa melayu tahun 3 jilid 2

- Salam maal hijrah 1443h

- Lee yi-kyung

- Uji matcha

- Happymod download ios

- Puspakom 预约

- Waktu solat parit buntar 2021

- Tarikh buka sekolah selepas pkp 3.0

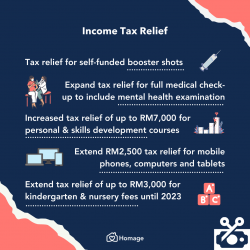

What Can You Claim For Tax Relief Under Medical Expenses?

For individual taxpayers in Malaysia, this can be done through a manual paper form, or through an online e-filing system Because most of these initiatives are for it means that they can only be used during the 2022 year of assessment.

The Covid-19 vaccine is free, for now at least.

As an added incentive, individual income tax at an average rate of 15% is given to non-citizens holding primary positions C-Suites for 5 consecutive years.

Things You Can Claim For Your 2021 Income Tax Relief

For income tax in Malaysia, personal and reliefs can help reduce your chargeable income, and thus your taxes.

To minimise disruption to company cash flow as well as incentivise the improvement of business premises and facilities, it is proposed that the foregoing incentive be extended until 31 December 2022.

Those are all the medical expenses you can claim for tax relief, and we hope that our breakdown of each expense provides you with the information you need to properly file for your tax relief this tax season.

- Related articles

2022 blog.dabchy.com