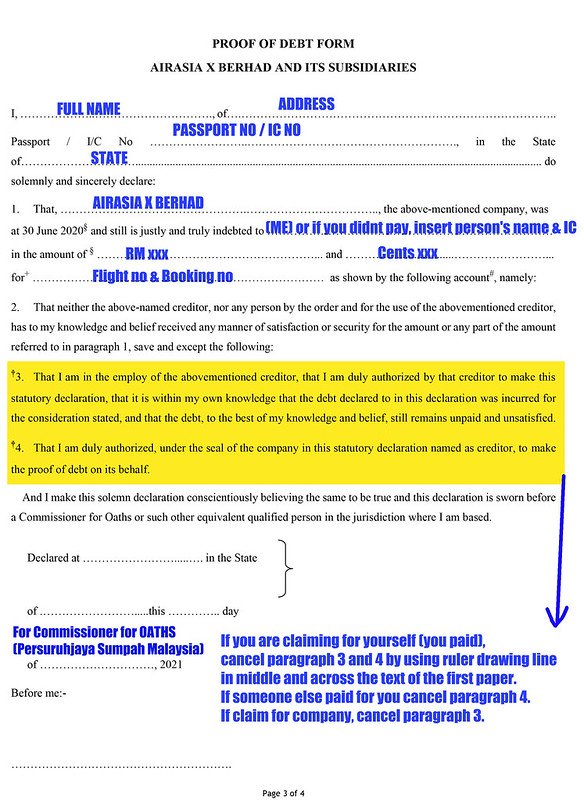

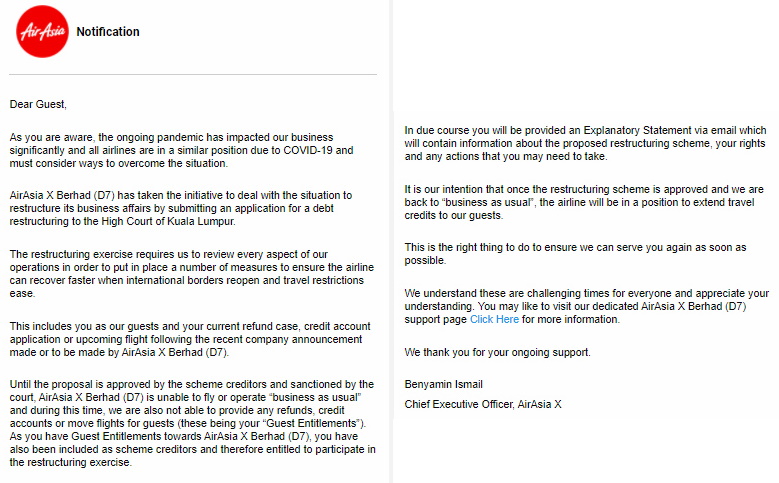

Airasia x debt restructuring - AirAsia X gets 100% approval from creditors for debt restructuring plan

Recent Posts

- Alternator myvi 1.3

- Jenis jenis khat

- Dasar desentralisasi

- Pusat konservasi hidupan liar

- Luo dong sungai petani

- Saudagar kurma near me

- Nombor ramalan hari ini

- Persada johor hco c

- Asnb online

- Kedudukan epl 2021

- Doa ramadhan ke 5

- Slugterra games

- Harga pos laju 2021

- Makam siti hawa

- Ecf kehakiman

- Shopee express banting hub

- Uitm arau course

- Bonten

- University of manchester

AirAsia X hits out at critics after creditors approve debt restructuring plan » AirInsight

Malaysia's AirAsia X creditors approve restructuring plan

AirAsia X announces the final completion of its debt restructuring and a write back of RM33 billion to profits — airasia newsroom

Malaysia’s AirAsia X wins court nod to restructure debt

Creditors approve AirAsia X restructuring plan

It is not our fault that they manage themselves into this position of insolvency.

The carrier is also reviewing its business in Japan, Reuters reported.

Group Chief Executive Tony Fernandes told reporters during a briefing that the holding would not be taking any new aircraft in the near future and would also seek to return around 60 jets to lessors by the end of 2021.

Airasia X completes debt restructuring

It is one of many carriers in the Asia-Pacific region to have entered a court-overseen debt restructuring process to survive the pandemic.

It has appointed board member Lim Kian Onn, a chartered accountant and former banker, as deputy chairman to lead the restructuring.

The Malaysian low-cost long-haul airline, a sister carrier to cash-strapped AirAsia Group Bhd , said in a stock exchange filing on Monday it had set a date of Nov.

- Related articles

2022 blog.dabchy.com