Malaysia tax rate 2021 - Malaysia Personal Income Tax E

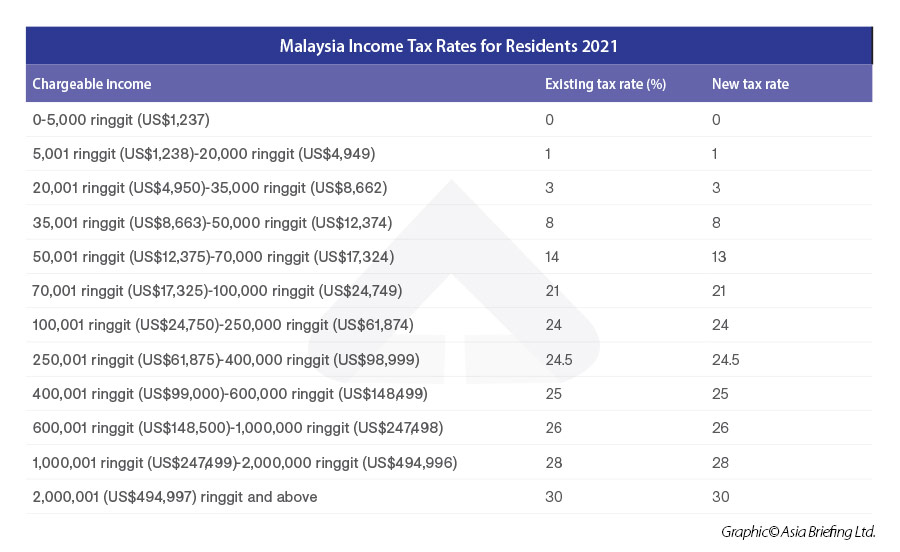

Tax Rate: Find Out Your Income Band And How Much You Need To Pay

Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels.

When Malaysia embraces a much modern and territorial tax system in comparison to international tax systems, will eventually make Malaysian companies more competitive and will eventually eliminate the need of Malaysian corporations from moving their wealth overseas in the pretext of tax evasion and avoidance due to obsolete and back dated tax systems.

There are , one with a fixed rate regardless of the amount stated in the instrument, the other which varies according to the nature of the instrument and the value stipulated.

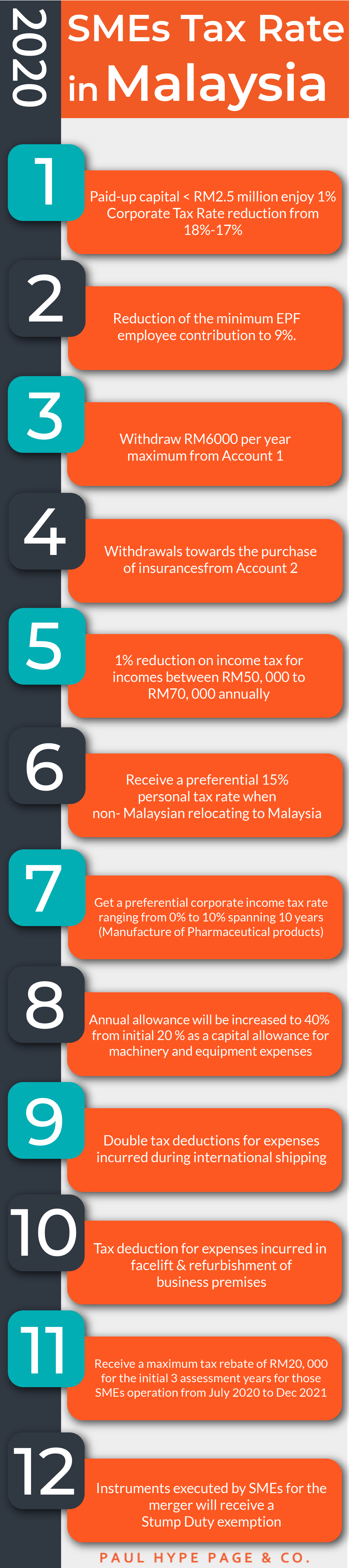

Malaysia Tax Reforms

By 2014, Malaysia was the world's third largest manufacturer of equipment, behind and the.

Retrieved 25 May 2011.

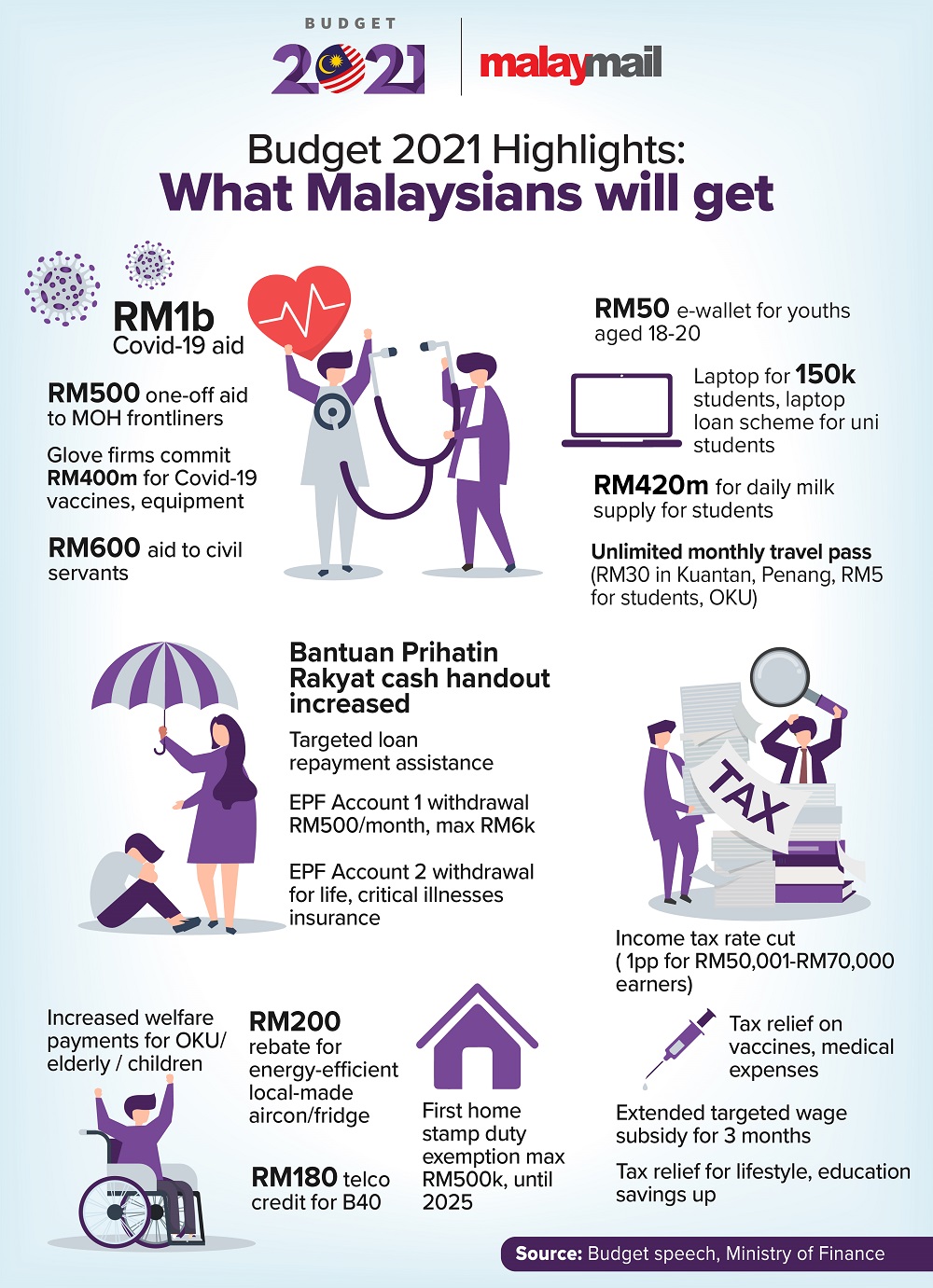

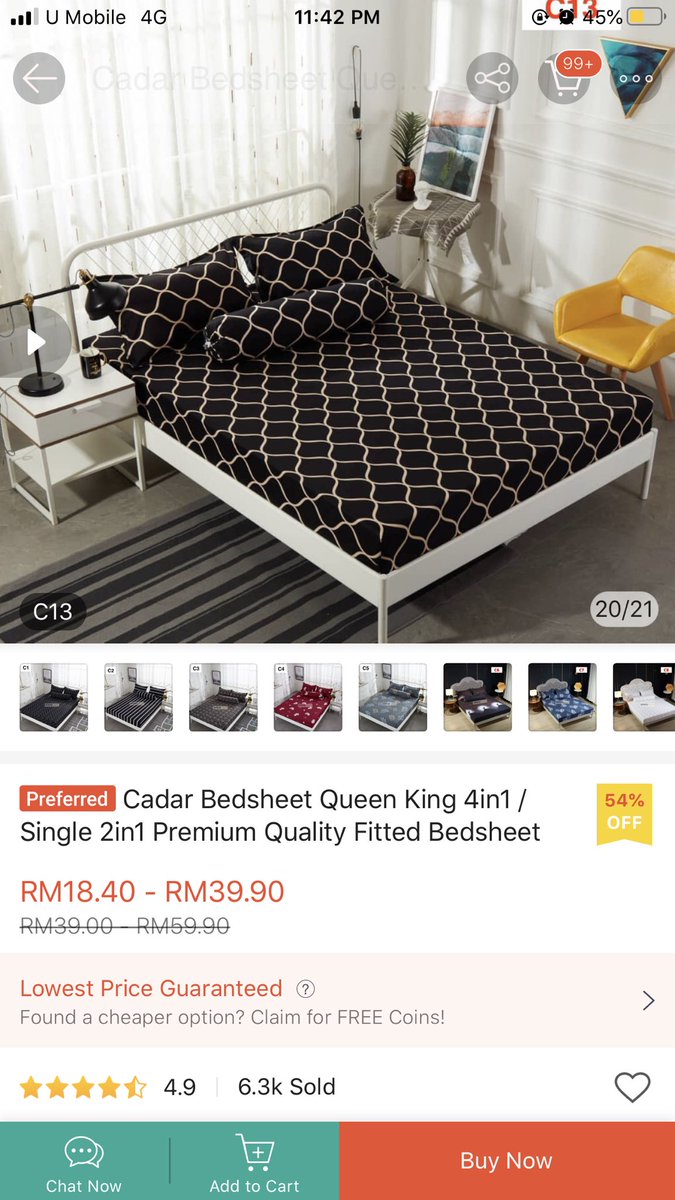

Malaysia budget 2022 businesses a higher income tax rate of 33% is proposed on chargeable income in excess of rm100 million, for the year of assessment ya 2022 only.

- Related articles

2022 blog.dabchy.com