Capital allowance rate malaysia 2021 - Malaysia: Finance Act 2021, effective 1 January 2021

Recent Posts

- Resepi kaya pandan azie kitchen

- Pak vs wi live score

- Semakan status kwsp 10k

- Ctc certificate ssm

- Professor emeritus maksud

- Edinburgh university

- Jadwal indonesia vs thailand

- Oasis clinic

- Jenis struktur organisasi perniagaan

- Blog serius

- Rangsangan dan gerak balas tingkatan 3

- Cara hilangkan dakwat undi di jari

- Harga mercedes amg a45

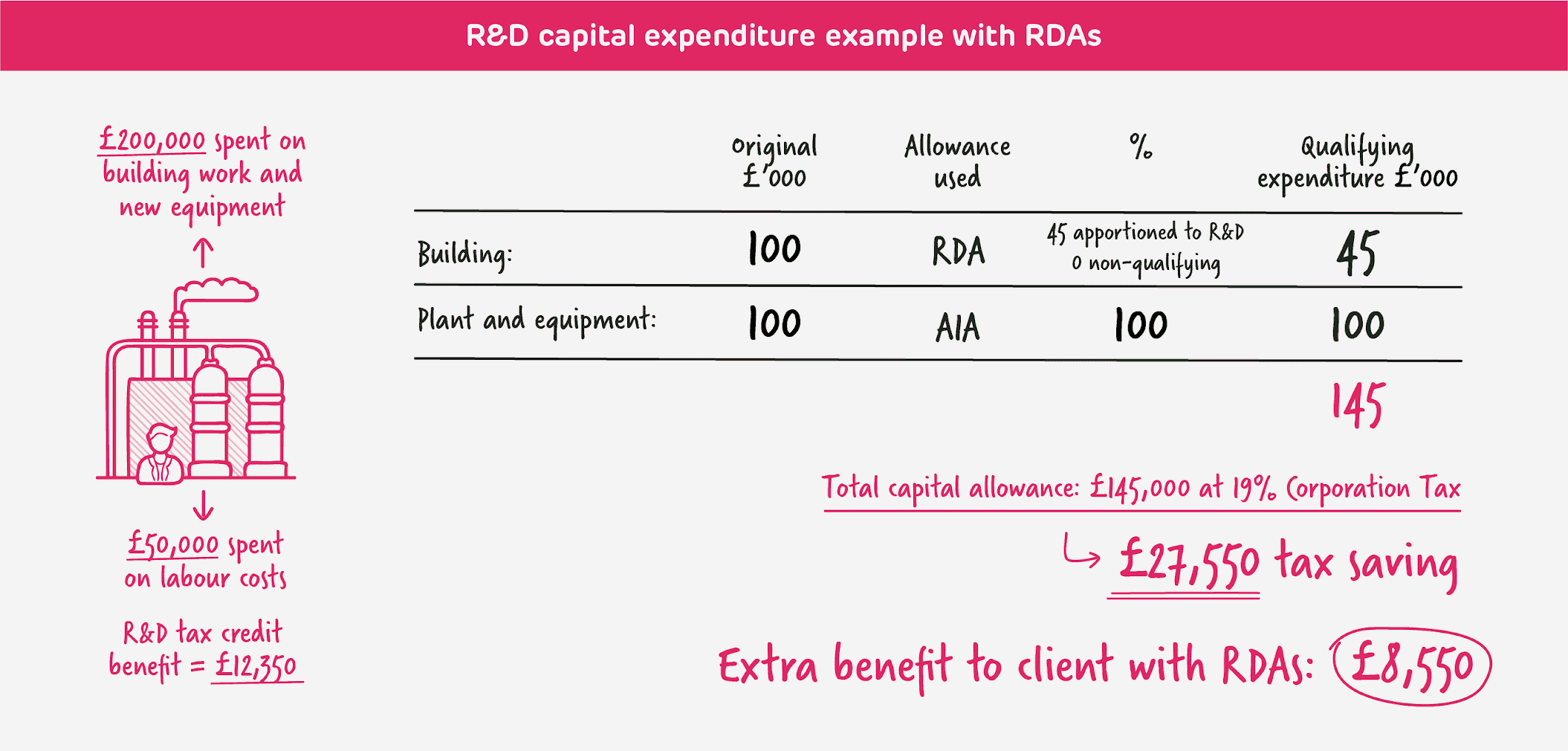

Capital Allowances Study

Our team works hard in ensuring that our clients do not miss out on the opportunity to enhance the claim, from identifying the entitlement through to delivering the tax benefits.

Capital expenditure is money a company spends on buying or maintaining land, buildings or equipment.

Alongside other generous enhancements to the capital allowances regime announced in Budget 2021, this measure provides a powerful additional incentive for businesses to invest in these designated areas in the short to medium term.

Accelerated Capital Allowances

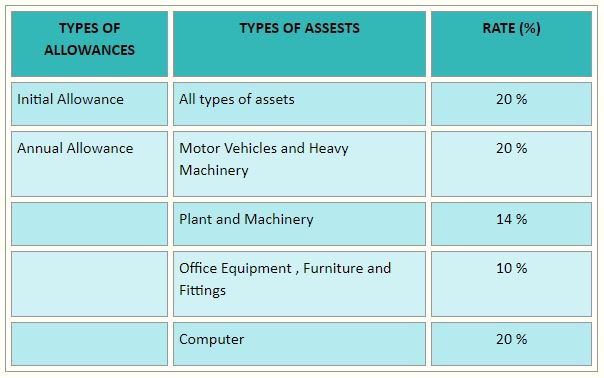

One of these deductions is the capital allowances in Malaysia.

What Are Capital Allowances And Balancing Charges? The most common type of Benefit In Kind are: i.

Aside from the tax laws continually updating, it also has many inclusions and exclusions you have to remember.

- Related articles

2022 blog.dabchy.com