Pbb bank share price - PBBANK

PUBLIC BANK BERHAD : Shareholders Board Members Managers and Company Profile

Banking as a public utility is a proven model worldwide.

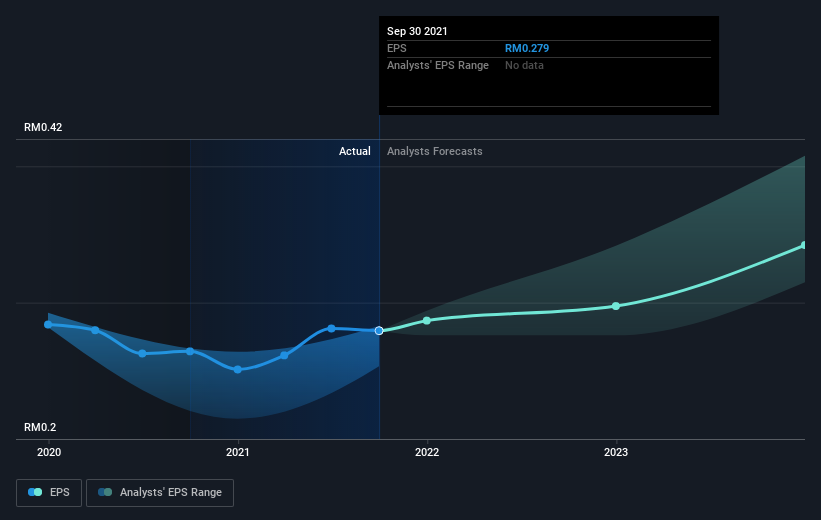

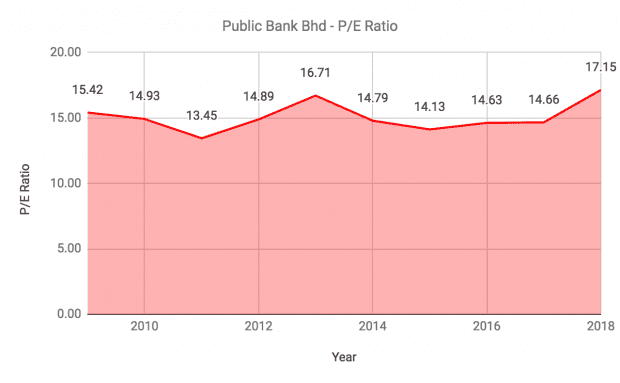

Is Public Bank Berhad a profitable investment? Public Bank Bhd is a Malaysian banking group that provides a range of financial products and services including personal banking commercial banking Islamic banking investment banking share broking trustee services nominee services sale and management of unit trust funds bancassurance and general insurance products.

Public Bank Berhad declared dividend 75 sen per share with a total dividend payout of MYR 146 billion representing 500 of the Groups net profit for the half year ended 30 June 2021.

PBBANK Share Price: PUBLIC BANK BERHAD (1295)

This means that as Public Bank grows, its net assets per share will also increase.

.

The Treasury segment manages liquidity of the bank and is a key component in revenue and income generation through its trading and investment activities.

- Related articles

2022 blog.dabchy.com