Epf contribution table 2021 - How to calculate your and your employer’s EPF contribution?

Recent Posts

- Berimbuhan awalan

- Gambar bts

- Bpr fasa 2 semakan status bayaran

- Fidyah orang meninggal

- Tanggal kematian nabi muhammad

- Big 4 accounting firms malaysia

- Phoebe bridgers

- Typhoon rai track

- Hbo go

- Quill orthopaedic specialist centre sdn bhd

- Galaxy fox

- Asahina aya

- Olympic skateboarding 2021

- Usa vs haiti

- Mr knight moon knight

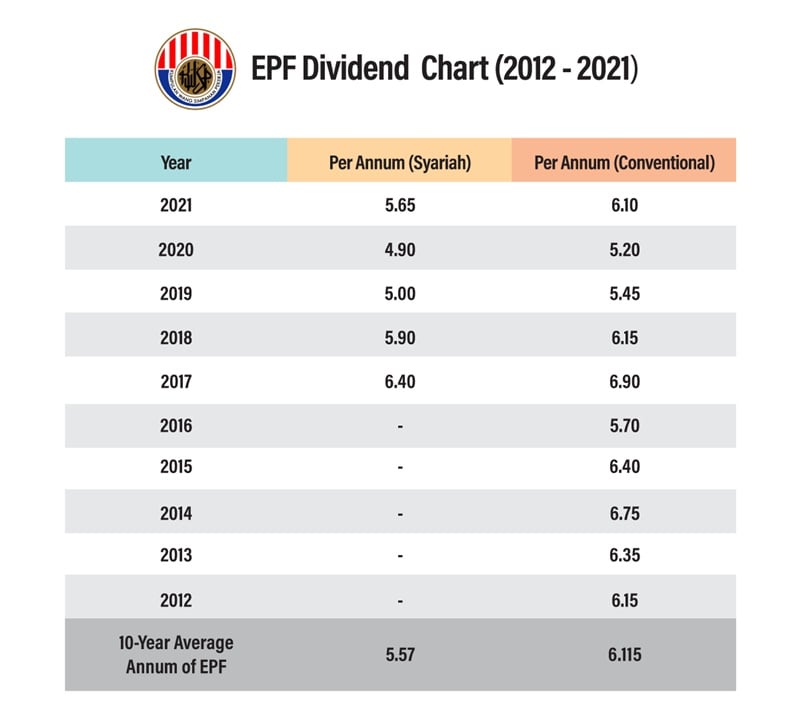

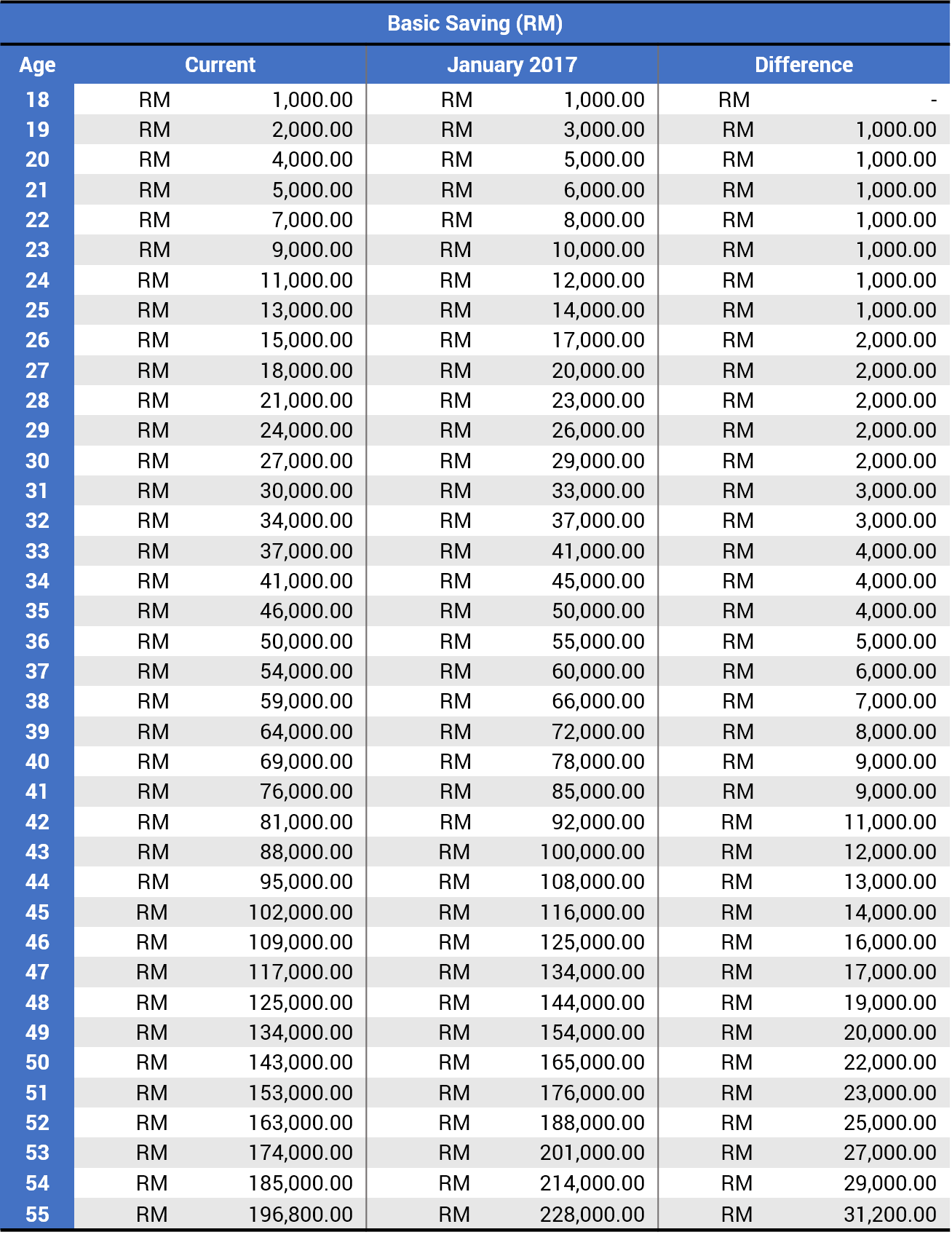

EPF Calculator 2022 and EPF Contribution in Malaysia

The 2015 budget saw, many worries go away, in hopes that both the employer and their employees will greatly benefit from it.

This interest rate is calculated every month and then transferred to the Employee Provident Fund accounts every year on 31st March.

For only 56 pesos per employee, you can automate these rules and processes so you can spend more time on more important things.

Employee Provident Fund (EPF)

It was formed by the Government of India.

The total amount to be credited to these subscribers will be equal to Rs.

An employee can also contribute up to 100% of their basic salary and dearness allowance in this scheme.

- Related articles

2022 blog.dabchy.com

/easy-baked-polenta-with-parmesan-cheese-3057179-step-04-5c291914c9e77c0001b1bb72.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/2751698/original/017918100_1552619091-HL.jpg)